Due to the fact the U.S. Introduces tough new pointers to cut back payday lenders, younger financial technology groups are taking reason at the excessive interest loan shops of their non-public manner, constructing services and products that allow personnel tap into their pay because it accumulates.

Organizations with names like PayActiv, FlexWage, Activehours, Clearbanc, or even purpose to clean the ragged earnings streams of many people which could ship them to payday lenders while monetary emergencies strike, regularly deepening their issues.

PayActiv chief Safwan Shah, for example, sells his offerings to employers as a way to beautify productivity thru easing the pressure that payday loans can cause their frame of people. PayActiv works with them to permit personnel to faucet into their wages outside the regular profits cycle, interior limits. Shah did a zip code evaluation of every organization he talked to and checked how many payday lenders were in every zone.

The argument intrigued Kendall Johnson, leader government of Baton direction favored hospital. He signed on with PayActiv, and now about 400 or so of his employees have enrolled in the service. One in each of them, 28-year-vintage sanatorium recruiter Amber Thompson, used it when she faced an unexpected cash crunch in among paychecks while she has become moving. In the location of turning to a payday lender or risking large overdraft fees, she walked to the PayActiv ATM in her constructing and took out $four hundred. PayActiv just gained a terrific of show award at FinovateSpring 2016 for its use of technology to ease the "coins glide struggles of running households."

Weekly and biweekly paychecks do no longer in shape the way many human beings work anymore. In a sign of the times, trip offerings along with Lyft and Uber have rolled out Instant Pay and Pay particular services for his or her drivers.

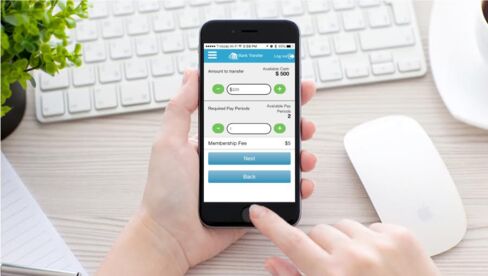

Supply: PayActiv

“So numerous our financial offerings these days are based totally on a stability of lifestyle and profits that only a few human beings have now,” stated Ryan Falvey, who oversees the economic Solutions Lab at the center for economic services Innovation. The Lab allows groups were jogging on modern services that help individuals enhance their budget.

That does not recommend having regular get entry to at least one's earnings is risk-unfastened. Activehours, which we could consumers choose what to pay for transactions via what it calls "tips," enables personnel with budgeting, stated Ram Palaniappan, CEO. “if you need to spend, you test if there are earnings in the app, and if there aren’t, you need to work extra earlier than you spend,” he said. “It’s very much like a commercial enterprise, seeking to make meet income charges.”

Furthermore, the share of earnings that employees can take, and the way regularly they could take it, may be constrained with the resource of employers. For now, Baton Rouge famous caps withdrawals at 50 percent of wages earned and a maximum of $500. An employee can’t take out every other loan till the number one one is repaid out of his or her paycheck.

Other corporations also can set the restriction at 75 percentage to 80 percentage of income and restrict the provider's use to as quickly as regular with pay cycle, said FlexWage CEO Frank Dombroski. "we're proper here to assist personnel that wants budget to avoid high-value options, not to help them act less responsibly," he stated. "Overdrafts are a larger socioeconomic problem than even payday lending, and fee clients $32 billion ultimate yr."

The service is frequently positioned as a monetary nicely-being advantage that can affect growth retention. PayActiv's Shah said being capable of tap profits this way can result in better financial conduct. He as compared it to grazing on food, in the choice to bingeing.

“get proper of entry to to cash in small dollar quantities while it’s needed has far more fee than ready to be paid and, inside the intervening time, getting into a debt trap, à la payday lending,” he stated.

It’s too early to the degree the results, despite the fact that some companies provide high excellent anecdotal proof.

At Baton course brand new, Johnson says employees are the usage of it when they have coins glide troubles and need such things as car restore, he said, now not turning to it every month—which modified into a preliminary mission approximately the carrier. He's visible a lower inside the style of employees the use of test-cashing websites and payday creditors, which call Baton path fashionable to confirm employment.

These early-diploma businesses are probably to face extended regulatory scrutiny because the area grows. Shah said PayActiv has had over a dozen conferences within the beyond two years with 25 to 30 people associated with the customer monetary safety Bureau's challenge Catalyst "in the spirit of maintaining them updated." project Catalyst's "undertaking is to inspire client-fine innovation in markets for purchaser economic products and services," in line with the CFPB net web site.

Dombroski stated FlexWage had been working with assignment Catalyst on a have a look at to quantify the impact of monetary stress. The CFPB said in an email that it "meets regularly with a spread of employer and advocacy stakeholders" but usually does now not "touch upon or talk particular products."

"I don't assume the consumer monetary Safety Bureau has placed a large eye on those businesses but due to the truth the numbers aren't there but," said Sam Maule, digital practice lead for NTT information Consulting. "The onus is on those companies to educate the regulators."

It additionally falls to them to train customers about how the product is meant to be used, said Cherian Abraham, a fee expert at credit score rating-tracking corporation Experian. "it is harder for businesses like those because their clients were called unprofitable through the usage of the traditional financial establishments," Abraham stated. "so that they have a harder task."

0 comments:

Post a Comment